I’m always on the lookout for good high-yield savings accounts and I recently found one that I think is the best high-yield savings account option currently out there. It’s called Raisin and when you open a Raisin account, you gain access to 40 banks and credit unions, most of which are offering high-yield savings accounts with 5% interest or more (Current highest rate: 5.32%). Perhaps most important, Raisin is free and all of your funds in Raisin are FDIC-insured or NCUA-insured. This makes Raisin a no-brainer account that – in my view – everyone should open.

Taking advantage of these mega-high-yield savings accounts is one of the first things I recommend people do when setting up their money system. Years ago (back when high-yield savings accounts offered interest rates of about 1%), I wrote about how I maximize my cash savings by using 5% interest savings accounts from Netspend, DCU, and others. These accounts still exist today, but their value is fairly muted at this point. With all of the better options out there, I no longer recommend anyone jump through the hoops of opening multiple 5% interest accounts to maximize their cash savings.

The great thing about Raisin, however, is that, unlike the original 5% interest accounts that I used to recommend, Raisin doesn’t require jumping through any hoops. Opening a Raisin account takes minutes to complete and as I mentioned before, it’s free and all of your funds are FDIC-insured.

With all that said, in this Raisin review, I want to go over what Raisin is, discuss how it works, and explain why I’m now using Raisin to store my emergency fund and any other cash savings I have.

What Is Raisin?

At the outset, when I first discovered Raisin, I was really confused about what it was. It advertised itself as a one-stop savings marketplace for different banks and credit unions, which in itself, doesn’t really tell me anything. Was this a bank account or was it some sort of list that showed you the banks paying the highest interest rates? I wasn’t quite sure.

Once I opened my Raisin account though, it became far more clear to me what Raisin is. The short of it is that Raisin is a platform that allows you to save money in different banks and credit unions from a single website. Here’s what Raisin says on their website:

Raisin is not a bank. It is a digital savings marketplace where you can fund federally insured deposit products with a wide range of maturities and APYs (annual percentage yield) offered by our partner banks and credit unions, allowing you to design a savings strategy customized to your earning and liquidity needs.

Source: https://www.raisin.com/en-us/faq

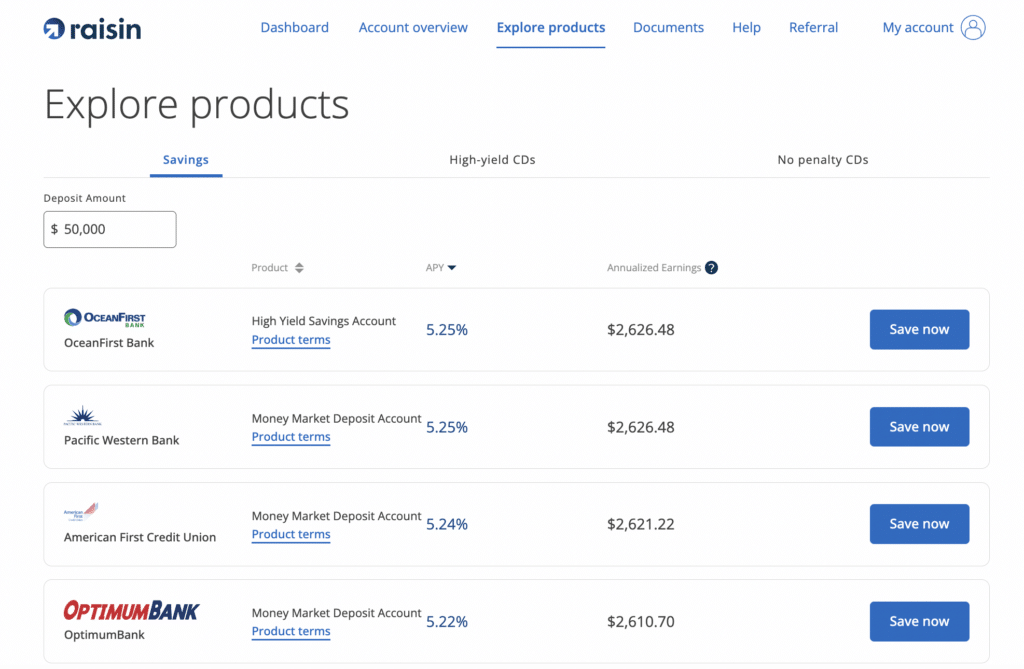

When you sign up for Raisin, you’ll be able to choose from different savings accounts offered by banks and credit unions that are on the Raisin platform. At the time I’m writing this, the majority of banks and credit unions on Raisin are offering high-yield savings accounts with 5% interest or higher.

To use Raisin, you first create a free account, then pick one of the partner banks on the Raisin platform. This becomes the bank that you store your funds in. Below is a screenshot from my Raisin account with some of the partner banks.

Once you pick a bank, you deposit your funds directly onto the Raisin platform. These funds are then kept in a custodial account with whatever bank you chose.

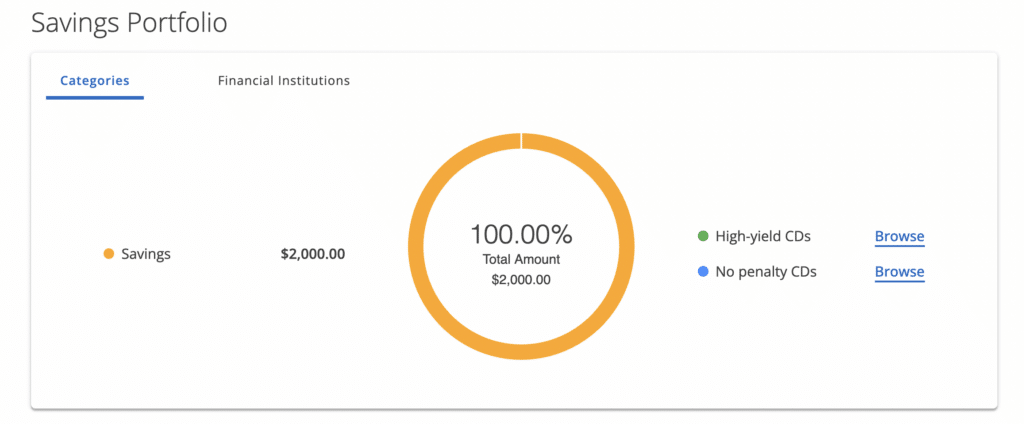

Your Raisin account functions exactly the same as any high-yield savings account and you can see your balance and withdraw your money from Raisin at any time. If you’d like, you can also open savings accounts with multiple banks, but you’ll still be able to see all your money in one central place via your Raisin dashboard.

How Raisin Works

When you deposit funds in Raisin, all of your funds are kept in a custodial account at whichever bank (or banks) you choose on the Raisin platform. All of your funds are FDIC or NCUA-insured, which means your funds are insured up to $250,000 at each bank.

Raisin has a helpful FAQ on its website that makes it clear that even in custodial accounts, funds are insured via pass-through coverage. Specifically, Raisin states the following:

Although Raisin customers’ deposits are pooled in omnibus custodial accounts, there is no impact on the eligible deposit insurance coverage you receive from the financial institution holding your savings. This is because the government entities providing federal deposit insurance — the FDIC for banks and NCUA for credit unions — permit pass-through coverage. So your money has the same coverage in a custodial account as if it were held in an individual account in your name.

Source: https://www.raisin.com/en-us/faq

Importantly, what makes Raisin a winner for me beyond being easy to use is that it charges no fees. So how exactly can Raisin offer their product with no fees?

Raisin explains it clearly on their website. The partner banks and credit unions pay Raisin to market their products to customers. For banks, this is part of their marketing expense. In return, they gain more deposits to their banks when customers find them on Raisin and choose their bank to save their money into.

Which Bank Should You Choose?

To get started with Raisin, you do have to pick a bank to put your money into. And with 40 banks and credit unions, it can be a bit confusing.

When I first opened my account, Western Alliance Bank had the highest interest rate, so I opted to use them. They’re also a large regional bank, so I figured it was probably a good option. That being said, I don’t think it really matters which bank you pick, as for the most part, all of the banks on the Raisin platform offer about the same interest rate.

It looks like Western Alliance Bank stopped taking new customers on Raisin, but there are still dozens of other banks offering 5% or more interest. Customers Bank is one option currently offering the highest rate (5.32%) on Raisin from what I can see.

But again, my suggestion is to not overthink it. The difference in interest rates between most of the banks on the Raisin platform is 0.05%. That’s an insignificant amount that won’t make any practical difference in how much interest you earn.

One question you might have is what happens if a bank offering a high-interest rate stops taking new customers. Interestingly enough, even if the bank stops offering the rate to new customers, you still keep the same rate. So while Western Alliance Bank stopped taking new customers at the moment, I’m still earning over 5% interest from them.

Using Multiple Banks On Raisin

Most people will probably only need to open a Raisin account using one bank – so pick a bank and go with that is what I’d say. That being said, there are three reasons why you might want to use multiple banks on Raisin.

The first is if you have a lot of money you want to set aside. Your funds are insured up to the federal limits (which is $250,000 per bank). To help protect your funds from possible bank failures, Raisin actually sets a $250,000 limit on how much you can deposit into each bank. So, if you have a lot of money to set aside, you’ll have to use multiple banks if you want to get all your money into Raisin.

The second reason you might want to use multiple banks is if you want to set up different sub-savings accounts. Raisin, unfortunately, doesn’t have a feature that lets you set up different sub-savings accounts. Instead, when you put your money into Raisin, it’s all shown to you as one big pool. However, if you want to differentiate your cash savings, you can use multiple banks, and then separate your money into each bank. You’ll be able to see how much money you have in each of the banks you’ve opened, which will make it easy for you to differentiate your savings into different buckets.

Finally, the last reason you might want to use multiple banks is if another bank ends up offering a higher interest rate than whichever bank you initially picked. However, I would only bother with this if the interest rate change was substantial. Most of the time, you won’t have to worry about this.

Raisin Review – Final Thoughts

Right now, with interest rates where they are, I think it makes sense for everyone to maximize their cash savings. I have no idea if this is the new normal and if interest rates will stay where they are, but if they do, you should take advantage of it. Banks should pay you for the money you keep in their accounts, and Raisin is a great way to make sure you’re getting the most out of your cash savings.

For me, Raisin is the perfect spot to put my emergency fund, allowing me to maximize my cash savings while still getting an excellent return on it. I haven’t yet used it to create different sub-savings accounts, but I’ll likely do that as well at some point.

For everyone, I absolutely recommend Raisin and think, at a minimum, this is where you should put your emergency fund. There are no fees, your money is safe and federally insured, and you can access your money at any time. My experience with Raisin has been great and I’m glad I found it.

If you want to sign up for Raisin, you can use this link to get started (this link will sign you up for Raisin using Customers Bank).

As always, if you have any questions, feel free to comment below or send me an email. I hope this Raisin review was helpful.